Subchapter S corporation or “S corporation” is a special tax status granted by the IRS, the status will allow corporations to pass their corporate income, credits and deductions on to their shareholders. Generally speaking, S corporations are exempted from having to pay federal taxes, the company’s shareholders therefore split up the income or losses amongst themselves and report on it in their own individual income tax returns. In the absence of corporate tax, the S corp tax rate will equate to the amount of the business owner’s personal income level on IRS tax brackets.

When faced with the discussion of picking between S Corp vs LLC, it can be difficult as both are useful entities to avoid double taxation issues. Fortunately, there are expert resources out there like The Really Great Information Company that provide in-depth coverage when it comes to all business-related quarries.

Ownership rules

Owners of an LLC, who are also referred to as “members”, are not limited in number and are also not required to be citizens or even residents of the United States as members can even be S corporations and C corporations. In the case of having to migrate ownership, LLCs are less flexible in comparison to S Corp’s. The owner of an LLC can only proceed with a transfer if all other members are in favour of the discussion.

In an S corporation the owners are referred to as shareholders and the IRS places stricter restrictions on the number of shareholders, limiting it to no more than 100 shareholders per S Corp. Shareholders are also required to be United States citizens or at the very least, permanent residents and unlike an LLC, S Corps cannot be owned by another business entity. However, shareholders can freely transfer their stock and the company can revert to another shareholder or an heir in the event that a shareholder should pass away.

Operation rules

The requirements for operating an LLC in most states is that the new venture needs to be registered within the state and adopts an operating agreement. Members are given an extent of flexibility with regards to how they wish to structure the operating agreement. Members can therefore have either equal ownership or allocated different units of ownership.

With regards to the operations of an S corporation, the rules become more rigid as they have to adopt the corporate bylaws, hold yearly meetings with the keeping of accurate minutes, as well as have a board of directors and corporate officers. In the event that the S Corp only has one shareholder, that person will be required to take on several roles.

S Corps and Taxation

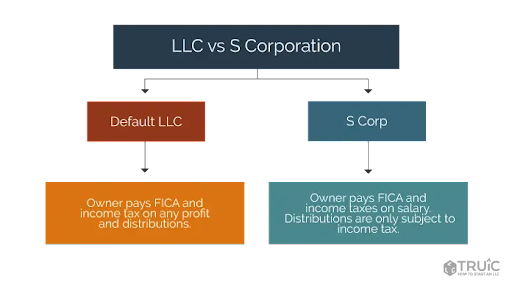

Pass-through entities such as LLC’s pass along losses, profits, deductions and credits to the owners. In the case of S Corp’s, the owners are the shareholders and they report this information on their personal income tax returns. The S corporation tax status proves to be an attractive choice as it offers liability protection and helps shareholders avoid double taxation, this is a contributing factor to why S Corps continue to be prevalent.

Having revenue taxed on both corporate and individual income tax levels is a norm for C corporation shareholders. To put this into perspective, S Corp shareholders are only taxed once and this is subject to their personal tax rate. Additionally, when forming an S Corp, the limited liability protection that owners receive will legally separate the business entity from its shareholders. This means that shareholders will not be held responsible for business debts or liabilities and creditors will therefore not be able to pursue the personal assets of a shareholder unless said shareholder signed to personally guarantee when taking on the debt.

A last note on owner salaries

LLC members are considered self-employed and therefore members do not receive a paycheck from the business nor do they have income or payroll tax deducted. Members instead make estimated quarterly payments towards their self-employment taxes and income. This varies drastically in contrast to S Corps whose owners are in fact considered employees who receive a reasonable salary and have income as well as payroll taxes withheld.

S Corps have a variety of pros and cons and it is entirely up to the entrepreneur to gauge if the cons conflict with their needs and what will work best for their unique business model.